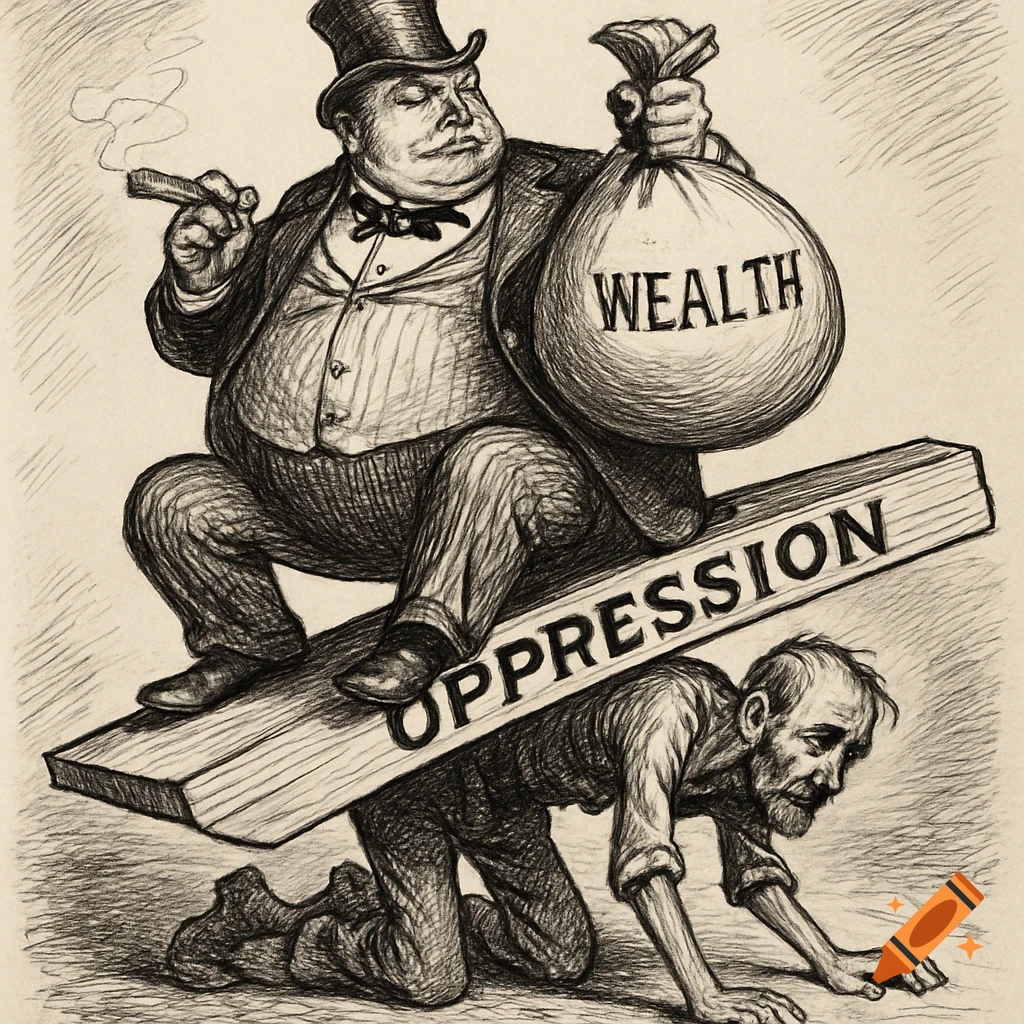

The Golden State is home to a few hundred people with wealth over $1 billion, many of whom amassed their riches as executives or investors in California technology companies. Oligarchs Peter Thiel (59) and Larry Page (52) are considering cutting or reducing their ties to California by the end of the year because of a proposed ballot measure for a one-time five percent tax on their Mammon-sized fortunes.

Billionaires are considering cutting or reducing their ties to California by the end of the year because of a proposed ballot measure that could tax the state's wealthiest residents.

-- The New York Times (@nytimes.com) Dec 26, 2025 at 6:55 PM

[image or embed]

California Wealth Tax Proposal:

"One-Time Wealth Tax on Billionaires: Billionaires living in California on 1 January 2026 would have to pay a one-time state tax equal to five percent of their net worth. The tax would be due in 2027. Taxpayers would have the option to spread the payments over five years, but would have to pay more to do so. Real estate, pensions, and retirement accounts would be excluded from the tax.

Most of the Money Set Aside for Health Care: Revenues from the wealth tax would be set aside in a special account. The state would decide how and when to spend the money but it would have to be spent on certain types of services. In particular, 90 percent of the money would have to be spent on health care services for the public. The rest would have to be spent on administration of the wealth tax, education, and food assistance. Other state laws that require some tax revenue to be used in certain ways, like spending on schools and building the state's rainy day savings, would not apply to this money."

Source: California Wealth Tax Proposal

"I ain't paying California a nickel for their healthcare programs! I need every single penny of my ill-gotten gains! GFY poor people!"

"Thank you for your attention to this matter."